INTRODUCING LENDIO INTELLIGENT LENDING

Evolutionary Technology.

Revolutionary Impact.

More loans, higher profits, more small business customers served.

Lendio Intelligent Lending is how lending should be.

INTRODUCING LENDIO INTELLIGENT LENDING

More loans, higher profits, more small business customers served.

Lendio Intelligent Lending is how lending should be.

MEET LENDIO INTELLIGENT LENDING

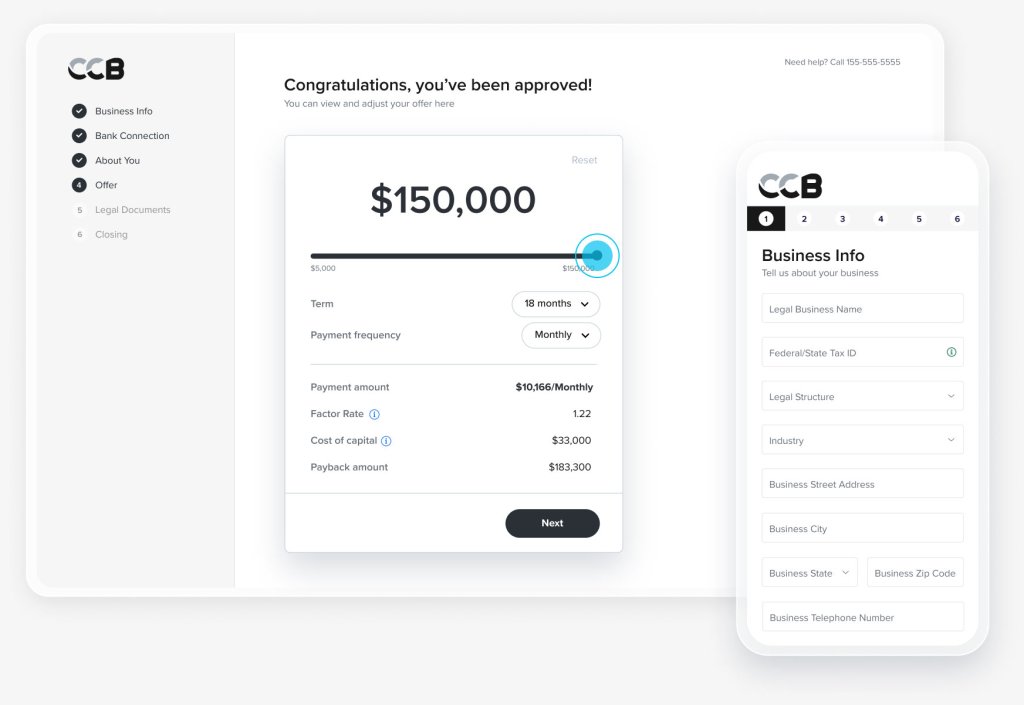

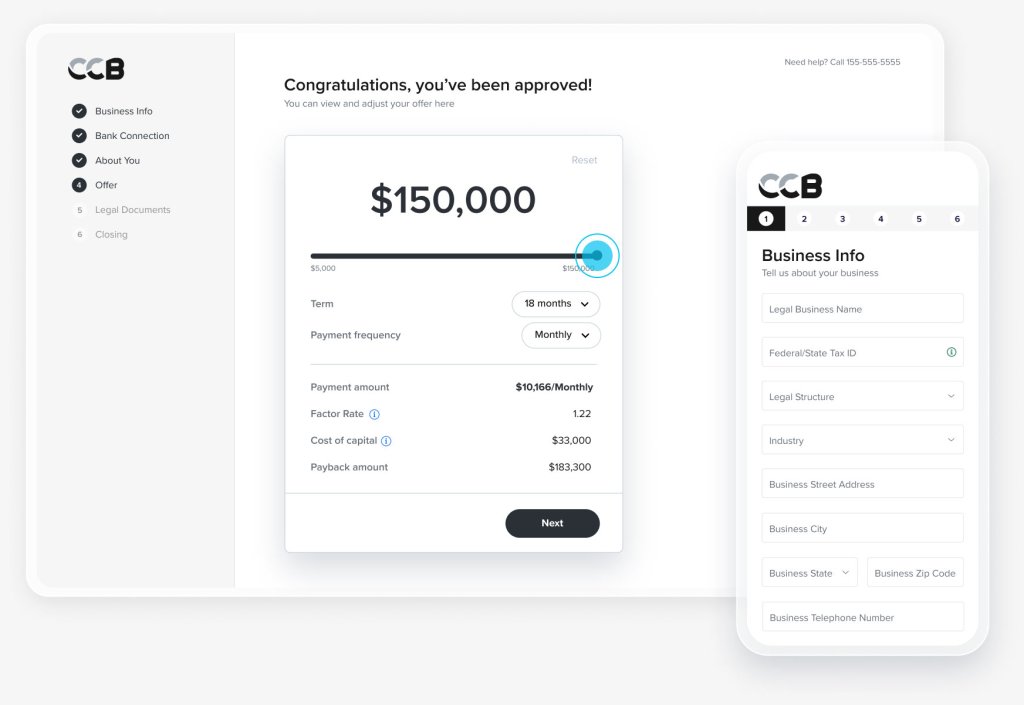

Lendio Intelligent Lending is more than loan-management or loan-origination software. It is a dynamic autonomous lending solution that fuses business logic with machine learning to boost risk management and automate decisioning. You gain confidence and reduce effort with every small business loan you close.

Backed by a team of data scientists, engineers, and customer experience experts, Lendio Intelligent Lending is a SaaS technology that delivers the following capabilities:

Lendio Intelligent Lending proactively synthesizes information to pre-qualify candidates for business loans.

The technology ingests data in real time to generate “soft offers” (initial offer with range up to a discrete dollar amount) within 15 seconds of receiving the application.

The solution manages the entire process from prospecting to underwriting. It will generate an offer in as little as 5 minutes.

Lendio Intelligent Lending compares borrower-submitted information with pre-validated third-party data to capture an accurate and comprehensive picture of the small business and its owner.

Lendio Intelligent Lending can be configured with the risk policies you set, to drive compliance and consistency.

Lenders may expand their market reach by joining Lendio’s Marketplace for small business loan. With 50%+ in SMB renewals, Marketplace has funded more than 350-thousand SMB loans worth $13B