Best invoice factoring companies for any small business in 2023.

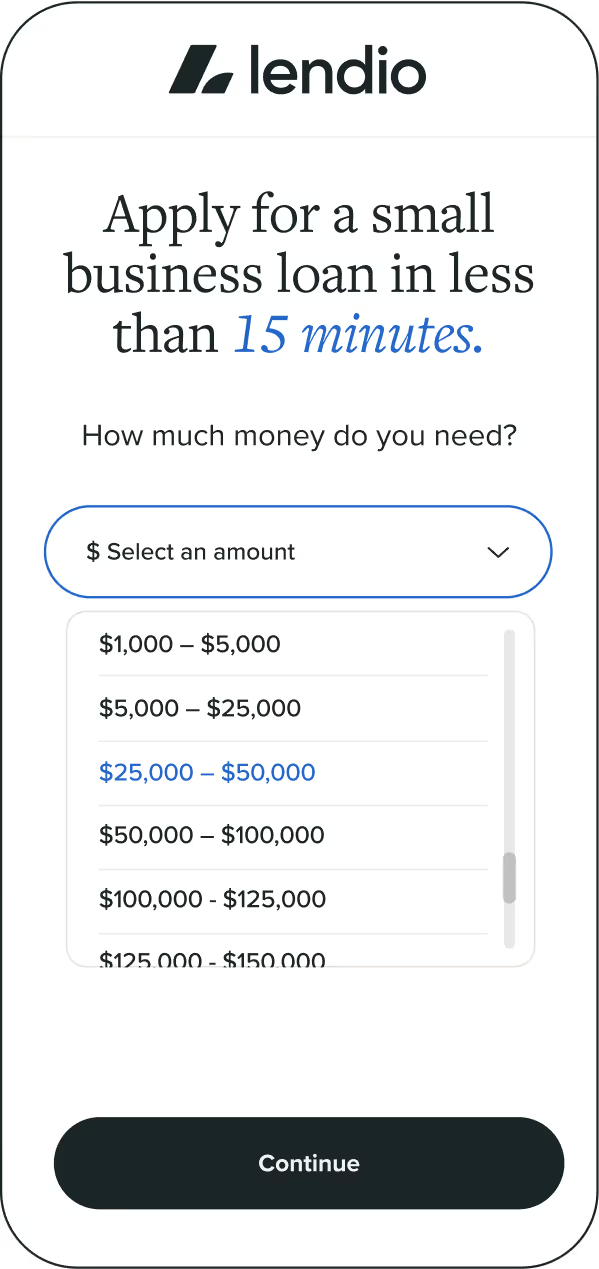

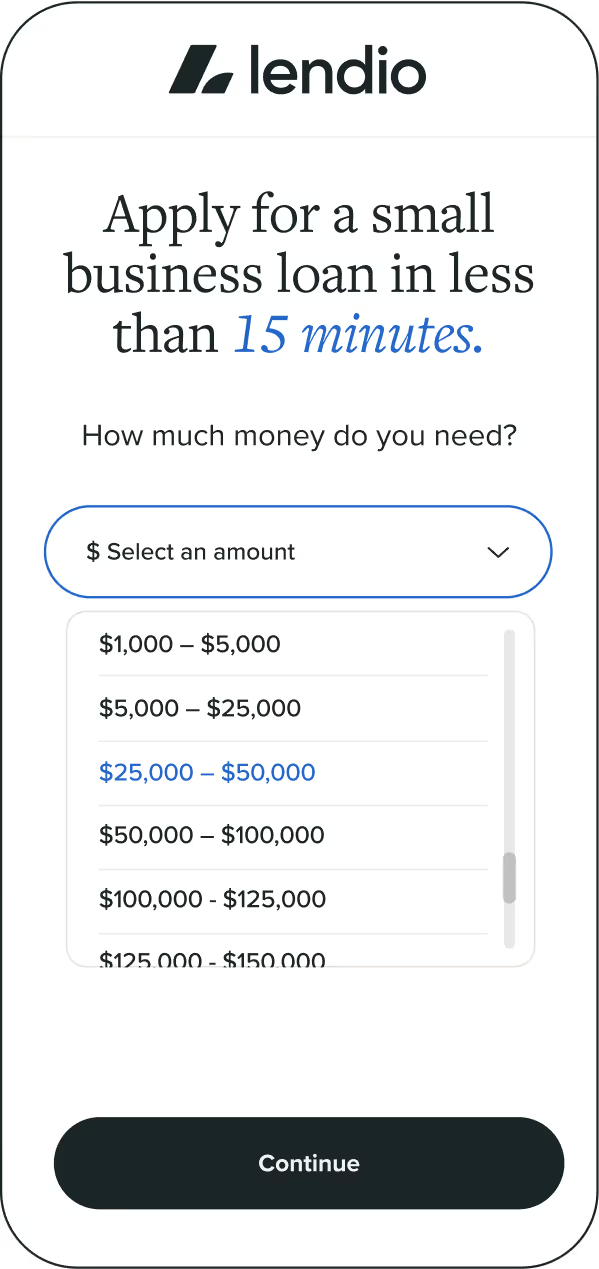

Ready to apply for a loan? Lendio works with 75+ lenders to find the right option for your business. Click "Apply Now" to fill out our simple application.

What is invoice factoring?

Best invoice factoring options.

Raistone Capital – Invoice Factoring

Gillman-Bagley – Invoice Factoring

Eagle Business Funding – Invoice Factoring

TBS Capital Funding – Invoice Factoring

Minimum requirements for a short-term loan.

*Qualification criteria, rates, and other funding terms will vary depending on the type and location of your business, and upon other factors. This is not a guarantee of funding, and it should not be relied upon as an accurate assessment of the availability or terms of the represented funding products.

Four simple steps to funding.

Tell us about your business.

Answer a few simple questions and complete the application in minutes.

Submit your application.

We’ll present your application to our marketplace 75+ lenders. Applying is free and won’t impact your credit score.

Compare offers.

Find the funding option with the terms that best fit your small business goals.

Get funded.

Once you accept, funding can hit your bank account in as little as 24 hours.

14+ years of serving small businesses.

Get the answers and the funding you need with support all along the way.

in small business funding facilitated in the last decade.

21,500 Trustpilot® reviews.

50% repeat customers.

total small business loans funded in the last decade.

Ready for funding?

See what you can qualify for on the Lendio Marketplace.

.avif)