Transaction analytics

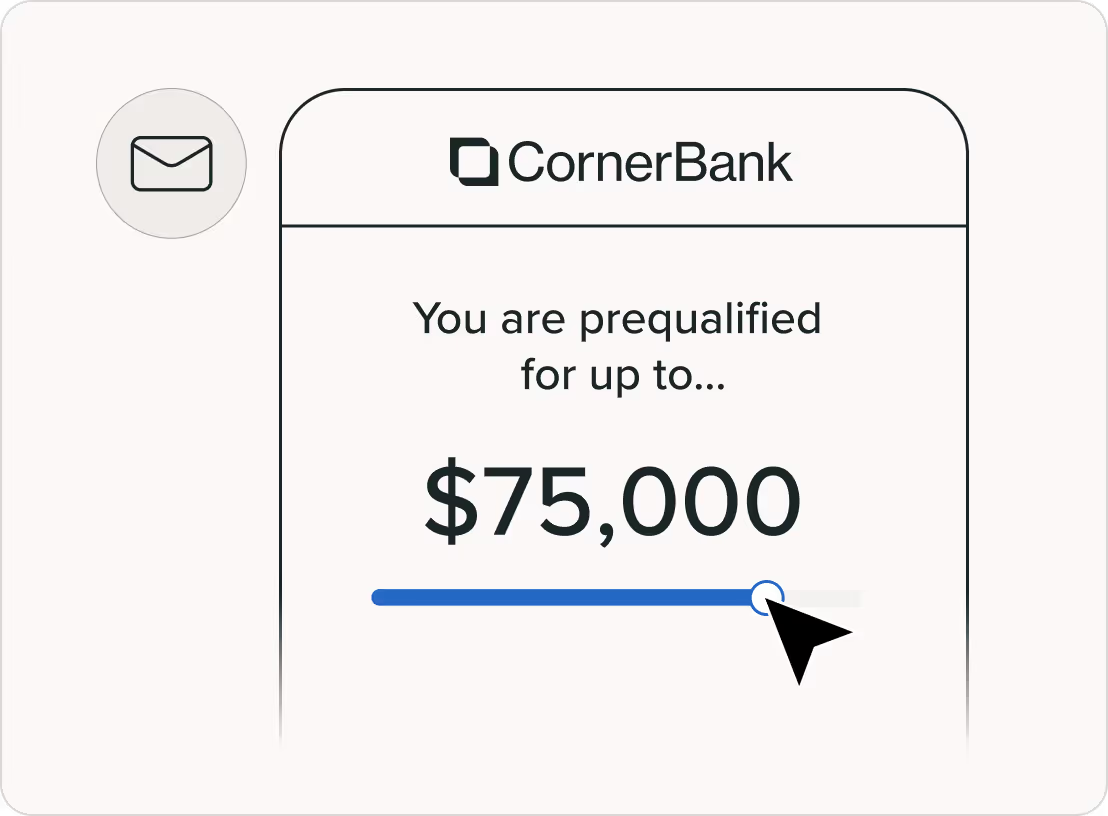

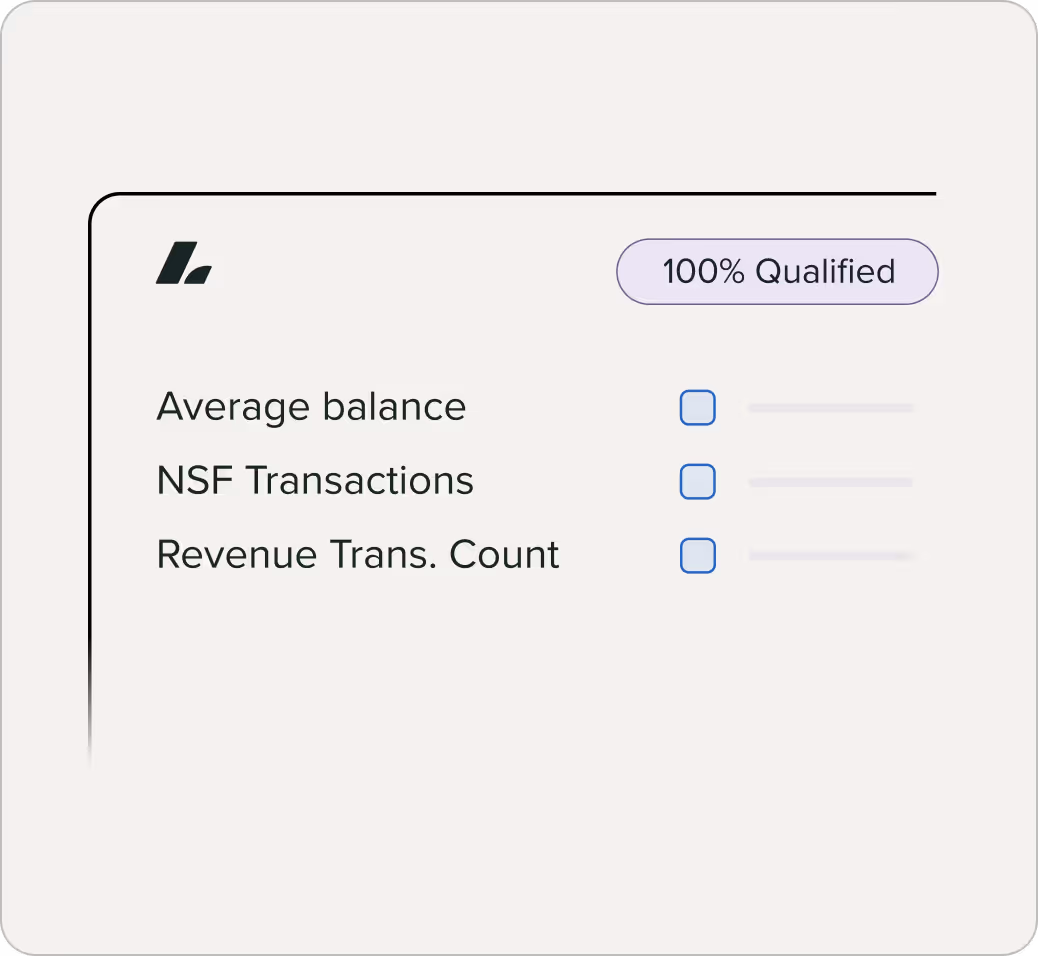

Prequalify and cross-sell your existing depositors.

Examine your small business depositor population against your loan policy and deploy customized prequalified offers.

Talk to our team

High predictive value leads to engagement and retention.

72% of banks say they can’t effectively cross-sell to their customers. With Lendio, a regional banking partner was able to prequalify 34% of their SMB depositors and drive $3.1M in loan volume with a single campaign.

Get a holistic view on applicant health.

Transaction classification powered by machine learning.

Lendio’s patented transaction analytics classifies and tabulates transactions, generating a clear picture on business financial health.

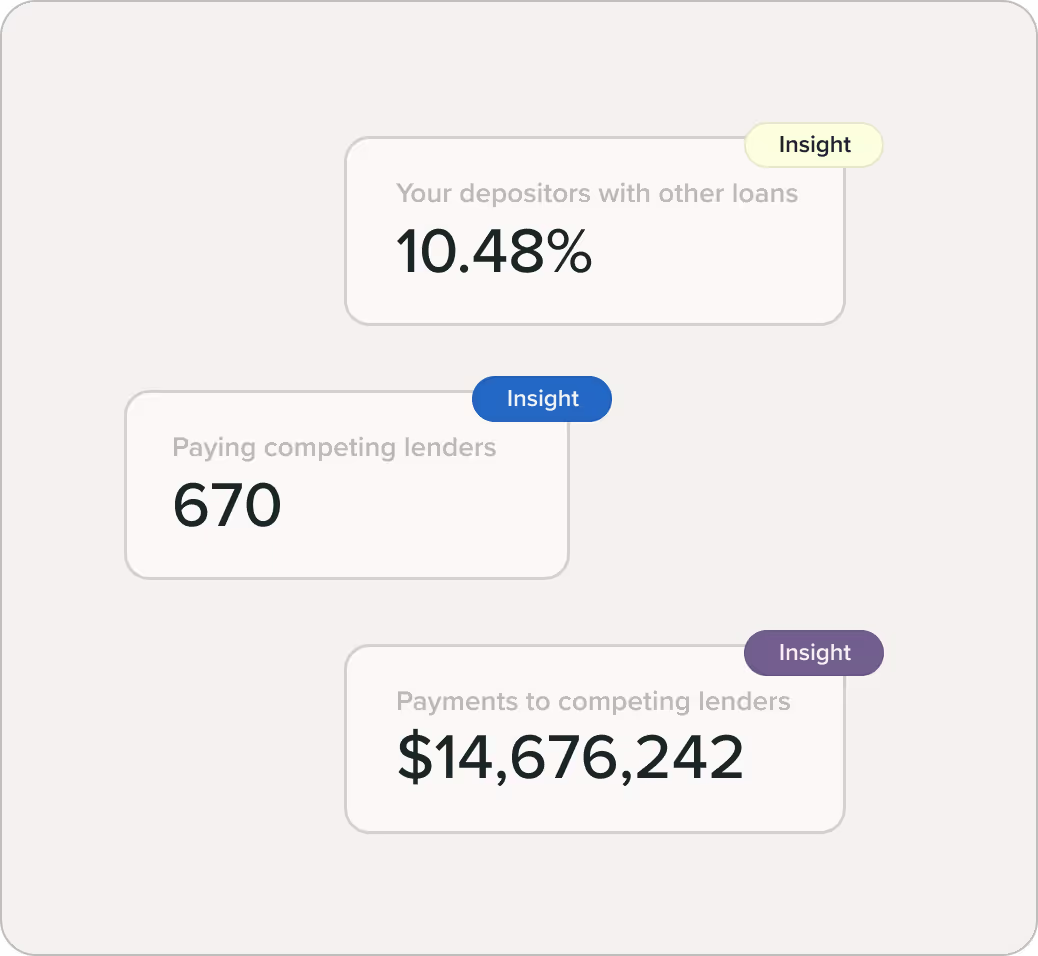

Unrivaled competitive insights.

Learn which competing lenders are already serving your depositors with loans and other financial products.

Predict loan outcomes and expand access to capital.

Leveraging transaction insights in your loan policy is an effective way to expand access to capital while managing risk.

Ready to learn more?

Let’s talk about how our Intelligent Lending platform can help you provide your small business customers the capital they need.

FAQs

Lendio Intelligent Lending is a SaaS platform that allows financial institutions to profitably serve small business owners of every size with capital solutions. Our platform includes critical capabilities that make small business lending scalable, including decisioning, digital loan application experience, transaction analytics, digital closing, and competitive intelligence. Our intelligent lending platform also seamlessly enables financial institutions to participate in Lendio’s marketplace to source new borrowers.

Lendio’s Intelligent Lending solution can act as your LOS for small business loans if you choose. Our solution is also architected to integrate with your existing LOS in a way that is complementary. Our Intelligent Lending software provides decisioning and digital application capabilities purpose-built for small business lending that extend beyond an LOS’s core capabilities.

Pricing for loan products can be configured to respond dynamically to borrower profile data. Common examples include setting maximum / minimum thresholds or ratios of change for data points such as:

- Credit score

- Time in business

- Average daily balance

- Average monthly revenue

- Term

- Payment frequency

- Rate/factor

A common example might be that a lender varies the APR and approved loan amount as a percentage of revenue depending on credit score. So a borrower with 725 credit might be approved for 12% of revenue at an 11% APR; while a borrower with 675 credit might be approved for 10% of revenue at a 13% APR.

Yes! Leveraging our Intelligent Lending technology gives you the option to acquire new borrowers through Lendio’s direct channels and our embedded relationships with enterprise small business service providers and retailers.