Find your funding in minutes.

Three steps to funding.

Share your vision.

Tell us about your business and your goals. We’ll present your application to our network of 75+ lenders who know small business.

Compare your options.

We work to match you with the right financing partner and product for your business needs, and can help you understand every option.

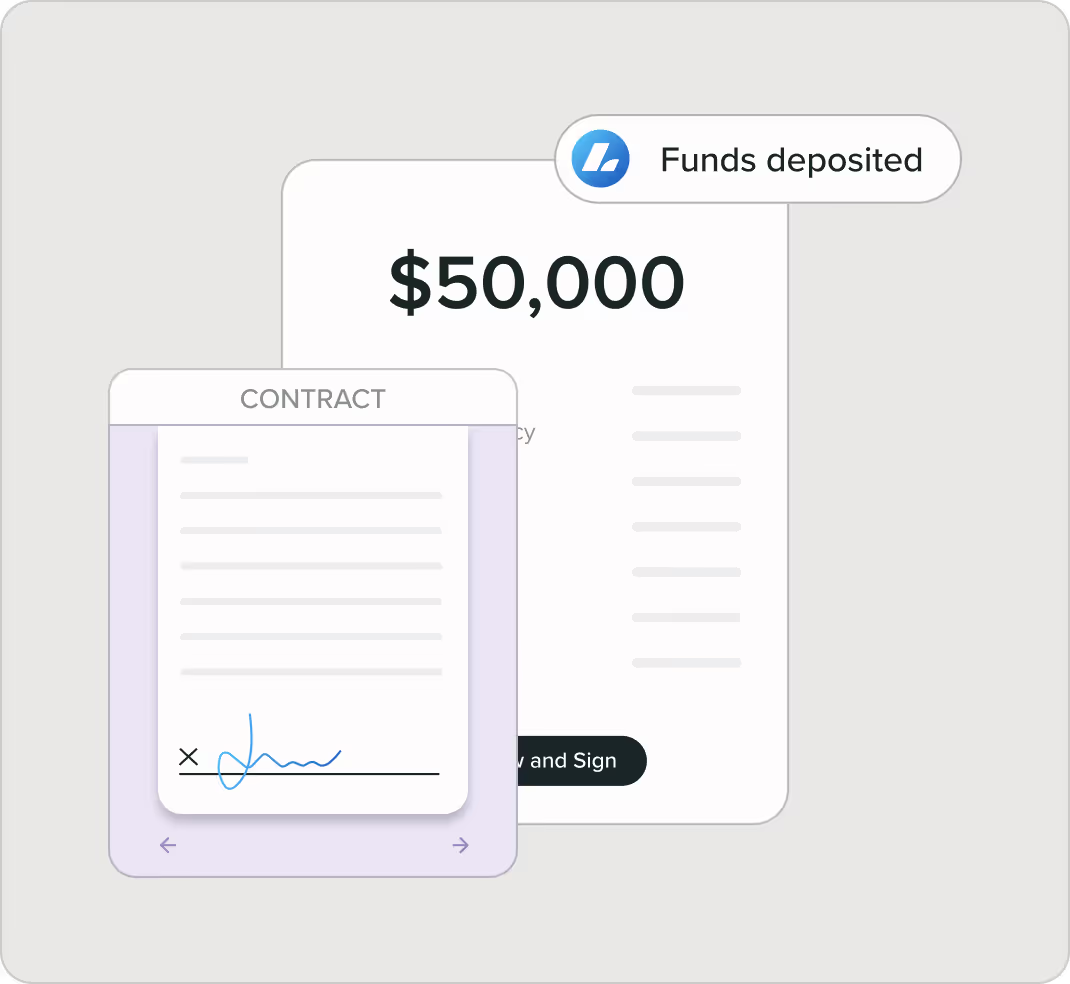

Get your money.

Once you feel confident about your choice, your business funding can hit your bank account as soon as the next business day.2

in small business funding facilitated in the last decade.

21,000 Trustpilot® reviews.

50% repeat customers.

providing broad coverage for small business lending.

Fund whatever’s next.

*Qualification criteria, rates, and other funding terms will vary depending on the type and location of your business, and upon other factors. This is not a guarantee of funding, and it should not be relied upon as an accurate assessment of the availability or terms of the represented funding products.

Lending resources

FAQs

No. Lendio is the nation’s leading small business financing platform. We work with more than 75 lenders and funders to provide small businesses with more options to borrow. However, Lendio does not make loans directly.

Yes, Lendio is a legitimate small business financing solutions platform. While Lendio is not a bank or loan-granting institution, Lendio partners with more than 75 lenders and funders—all thoroughly vetted—to provide small businesses with more choices all from a single online financing application.

Currently, Lendio does not offer grants. A great place to look for small business grants is the Small Business Association (SBA). Learn more here, or contact the SBA directly.

Lendio is transforming small business lending by connecting small businesses, lenders, and small business service providers through a single integrated technology platform. The Lendio Marketplace matches business owners with funding from over 75 lenders and financial partners, all through one simple online application. Lendio’s Embedded Marketplace brings this experience seamlessly to small business service providers’ ecosystems, allowing them to embed a full loan application and funding solution within their platform. For banks and lenders, Lendio’s purpose-built software integrates within their tech stack to automate small business loan decisioning, underwrite applicants, and connect financial institutions with curated applicants from Lendio’s direct and embedded marketplaces. With a single technology platform, Lendio is fueling the dreams of small business owners wherever they seek capital. Since 2011, Lendio has facilitated more than 400,000 small business loans and other financing options totaling over $16 billion.

.png)