Best startup business loans.

You've got the startup, now get the funding.

Launch your startup to greatness.

Know how much you can afford.

In addition to your loan amount, startup loans are determined by your interest rate, term, and collateral. These factors can vary substantially depending on the type of startup loan you choose. You can use our startup loan calculator to estimate your monthly payments.

Best startup business loans.

Headway Capital – Line of Credit

Clicklease – Equipment financing

Credibly – Revenue-based financing

Gillman-Bagley – Invoice factoring

Eagle Business Funding – Invoice factoring

Minimum requirements for a startup business loan.

*Qualification criteria, rates, and other funding terms will vary depending on the type and location of your business, and upon other factors. This is not a guarantee of funding, and it should not be relied upon as an accurate assessment of the availability or terms of the represented funding products.

Options for startup financing.

Personal investment

Crowdfunding

Invoice financing

Equipment financing

Business credit card

Revenue-based financing

Business line of credit

Business term loan

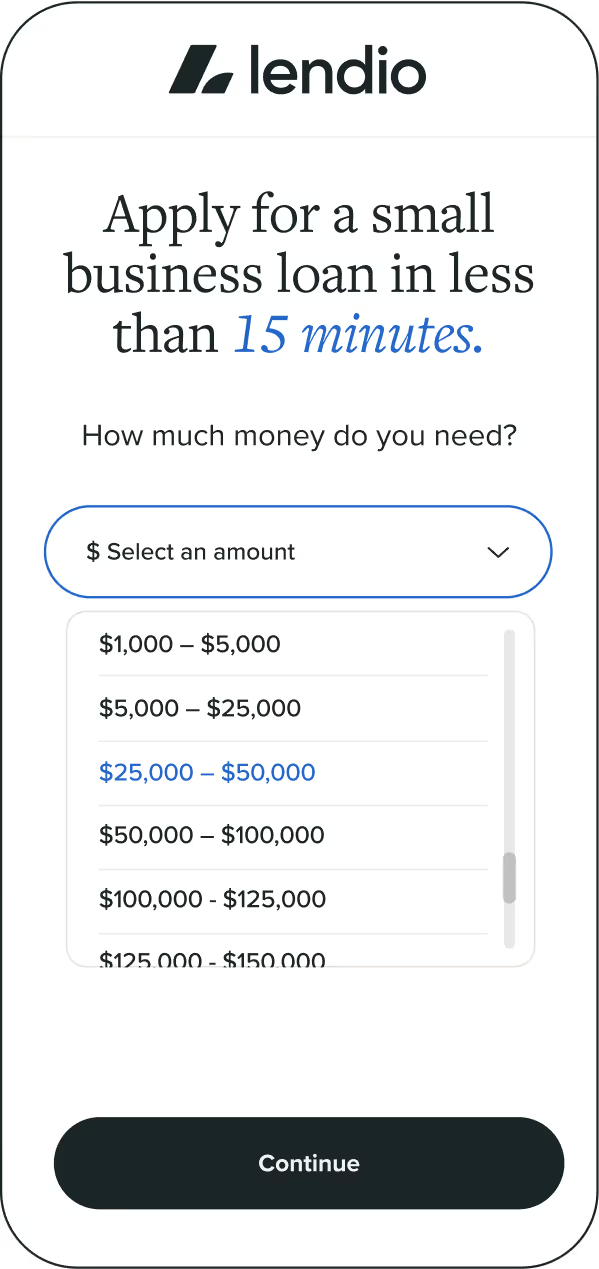

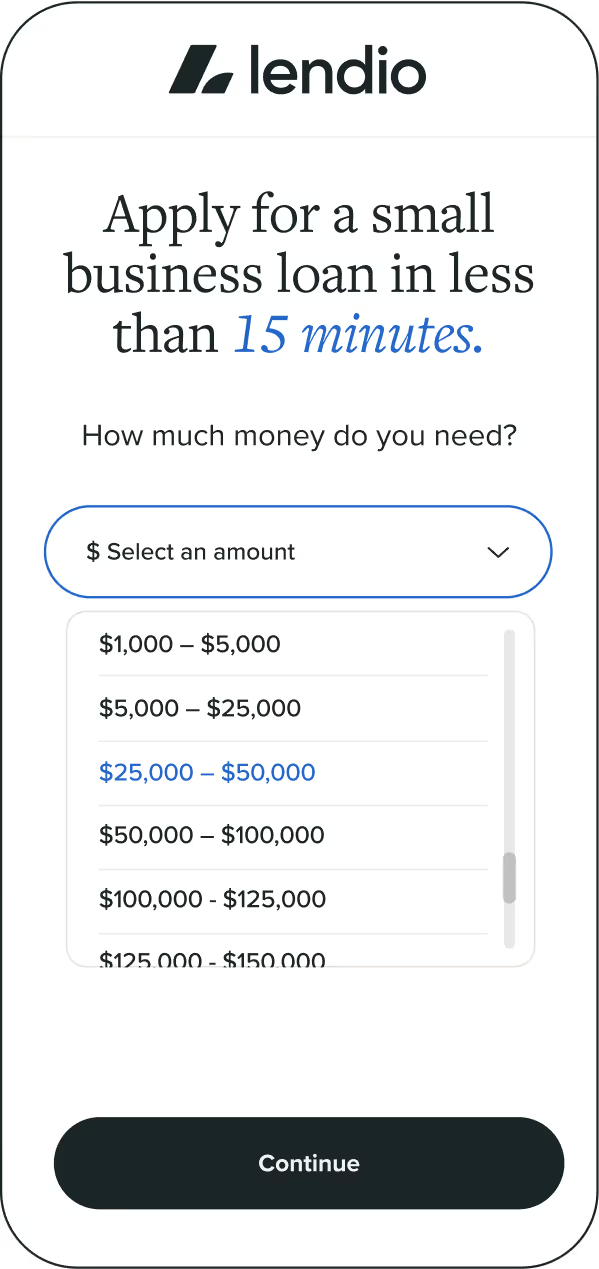

How to apply for a startup business loan.

Tell us about your business.

Answer a few simple questions and complete the application in minutes.

Submit your application.

We’ll present your application to our marketplace 75+ lenders. Applying is free and won’t impact your credit score.

Compare offers.

Find the funding option with the terms that best fit your small business goals.

Get funded.

Once you accept, funding can hit your bank account in as little as 24 hours.

14+ years of serving small businesses.

Get the answers and the funding you need with support all along the way.

in small business funding facilitated in the last decade.

21,500 Trustpilot® reviews.

50% repeat customers.

total small business loans funded in the last decade.

FAQs

Find answers to some commonly asked questions about startup business loans.

To qualify for a startup business loan, business owners will want to focus on both building financial health and establishing clear financial documentation.

Increase your credit score: Most lenders will look at your credit score along with your business’s credit score. If your credit score is below 700, work on improving your credit by paying bills on time, consolidating and refinancing current debt, and using a credit card for regular expenses to build a credit history.

Manage cash flow: The amount of cash coming into your business plays a huge role in your ability to pay your bills and pay back a lender. Follow this guide to learn effective cash flow management strategies.

Set up a business bank account: Creating a separate bank account for your business will allow you to better track income and expenses and predict cash flow.

Establish bookkeeping records: Lenders will want to review your business’s key financial statements, so having good bookkeeping practices in place will make it easier to compile the documentation you need when you apply for the loan. Dive into bookkeeping best practices here.

Businesses should evaluate multiple factors when considering a business loan including the overall cost and unique position of the business. Reviewing the following factors can help you narrow down which lenders are right for you.

Minimum requirements: Each lender will have its own set of minimum requirements to qualify for a loan. Check to see if you meet basic requirements for time in business, monthly revenue, and credit score. Consider if it may be worth waiting for a longer time in business or repairing your credit score, so you can qualify for a loan type with better terms.

Business need: Certain loan products, such as equipment financing, can only be used for a specific use case. Others will have a longer application process. Consider your use case for the funds, and how quickly you need access to them before selecting a vendor.

Industry: Some lenders restrict working with certain industries while others specialize in industries such as healthcare or eCommerce. Check to see if a lender works with your industry to improve your chances of approval.

A startup loan empowers you to invest in your own business. Instead of giving up equity to investors, a startup loan lets you keep it while providing access to the working capital your startup needs. That means you’ll have the freedom to move into a larger office space or order the inventory you need to fulfill those massive purchase orders that keep rolling in.

Startup loans are awarded based on the business owner’s personal credit history. That’s one of the aspects that makes startup business loans such an accessible financing option for new businesses.

If you have a poor credit history, you may still qualify. Before you commit to a startup loan, you’ll want to consider what’s affected your credit history in the past. If you have a history of late payments, it’s in your best interest to consider whether you can afford the loan and if you can meet the payment schedule. For those looking to build credit, a business credit card can be an excellent fit because it provides access to financing and an opportunity to build credit for your business—and you’re not required to use the capital.

The process to get a startup loan or something exciting like an SBA or government loan can be a stressful venture. Fortunately, rather than spending days or weeks hunting for the right loan, you can easily apply through Lendio, and we’ll help you choose the best startup solution for your unique situation.

Loan types and amounts vary depending on your situation. Through Lendio, you can find loan options that offer up to $2,000,000. With that chunk of change, you could build the business of your dreams, but the first step is to apply.

While some loans may require some money upfront, you likely won’t need to worry about that with many of your startup lending solutions. That said, the best way to know for sure is to get your free application in and speak to one of our loan experts.

Crowdfunding on websites like Kickstarter and Indiegogo are helpful when an entrepreneur focuses on raising small amounts of money from a large number of people. This can result in a large influx to the financing aspirations of a small business.

Both these sites and many others allow businesses to pool small investments from a number of investors instead of forcing companies to look for a single investment. There are many different ways to crowdfund as this method of financing is typically available to any type of startup business. Some rely on the strength of their campaign, some offer rewards and incentives to their supporters, and others provide shares of their business.

A startup business loan can be used for working capital, equipment, or other expenses of a new business. The structure of the loan will depend on the loan type. In general, businesses with a longer time in business will qualify for more loan offerings than those just getting started.

Yes, it can be difficult to get a business loan to start a business. While a handful of lenders will work with businesses from day one, the majority want to see a business with a history of at least 6 months along with a steady stream of monthly revenue. The owner’s credit score also impacts eligibility.

Ready for funding?

See what you can qualify for on the Lendio Marketplace.