Revenue-based financing to grow your business.

Get fast access to working capital based on future income with revenue-based financing.

What is revenue-based financing?

Revenue-based financing is a form of funding that offers businesses quick access to funds by borrowing against the money they will make. The borrowed money is then repaid through fixed daily, weekly, or semi-monthly draws from your account.

This type of financing can go by a few different names in the industry, depending on the financing company and the specific structure of the agreement, including:

- Business cash advance (BCA)

- Merchant cash advance (MCA)

- Working capital advance

- Automated Clearing House Loan (ACH)

- Purchase of future receivables

How revenue-based financing works.

These payments are used to repay the principal of the advance, plus the factor rate of the funding.

Minimum requirements for revenue-based financing.

Best revenue-based financing companies.

*Qualification criteria, rates, and other funding terms will vary depending on the type and location of your business, and upon other factors. This is not a guarantee of funding, and it should not be relied upon as an accurate assessment of the availability or terms of the represented funding products.

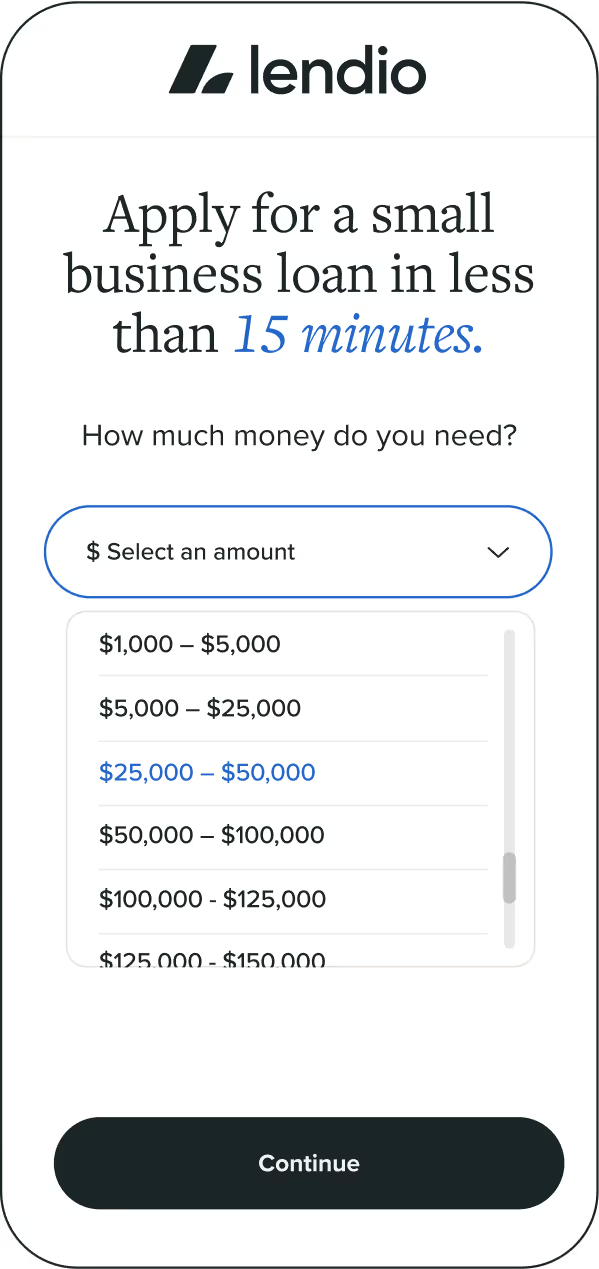

How to apply for revenue-based financing.

Tell us about your business.

Answer a few simple questions and complete the application in minutes.

Submit your application.

We’ll present your application to our marketplace 75+ lenders. Applying is free and won’t impact your credit score.

Compare offers.

Find the funding option with the terms that best fit your small business goals.

Get funded.

Once you accept, funding can hit your bank account in as little as 24 hours.

14+ years of serving small businesses.

Get the answers and the funding you need with support all along the way.

in small business funding facilitated in the last decade.

21,500 Trustpilot® reviews.

50% repeat customers.

total small business loans funded in the last decade.

FAQs

Find answers to some commonly asked questions about business and merchant cash advances.

Revenue-based financing is an option for startup businesses that may not yet qualify for other types of business financing. Because revenue-based financing is repaid based on your business’s income, time in business and other factors that can make securing financing difficult for startups don’t apply. If your startup has a strong income, revenue-based financing could be an excellent solution for your fast-capital needs.

The benefits of revenue-based financing make it such a convenient form of funding. Because eligibility is based on the ability to repay the advance, the requirements for this type of funding aren’t too strict, making it ideal for new businesses or those with bad credit or lack collateral. Plus, you can get funding quickly with a cash advance. And, if you have low sales, your payments will stay low too.

The disadvantages of revenue-based financing can sometimes outweigh the pros. It can cost you quite a bit depending on the factor rate of the advance. Plus, there’s no benefit to repaying early like there might be on other funding options.

Pros:

Quick to apply

Good for borrowers with low credit

Low revenue = low payments

Cons:

High cost of capital

Shorter term lengths

Frequent payments

Before taking a cash advance or any funding option, compare it with the other funding options available. Merchant cash advances are a unique form of financing with benefits and drawbacks:

Merchant Cash Advance Pros

- Speed of funding: Cash advances are quick to fund and can often provide cash within 24 hours of approval.

- Not collateralized: Generally, no collateral is required for a merchant cash advance.

- Long business history not required: Cash advances are often pitched to newer businesses or businesses with a shorter financial history, although you may be asked to provide 3-6 months of bank statements, receivables, or daily sales records.

- Won’t appear on a credit report: Due to the unique structure of a merchant cash advance payment, it’s actually considered a sales transaction. This designation means it won’t appear on a credit report.

Merchant Cash Advance Cons

- Expensive: Merchant cash advances typically have higher rates than other types of business financing. A high rate or longer repayment period due to low sales can result in an overall higher cost of financing.

- Not federally regulated: Since merchant cash advances are considered commercial transactions, they lack some regulations and requirements associated with other borrowing options.

- Business credit may still be checked: Some financiers may check credit before approving the advance, which can impact the factor rate of the advance.

- Doesn’t improve your credit: As mentioned above, due to the unique structure of a merchant cash advance payment, it’s considered a sales transaction and usually doesn’t appear on a credit report. But this means repayment of a merchant cash advance also won’t help build credit history or improve a credit score.

A cash advance can be used for a variety of business expenses. These may include purchasing inventory, covering emergency costs, investing in marketing efforts, managing seasonal sales fluctuations, renovating business premises, or even expanding the business. Essentially, a cash advance provides a flexible solution for any short-term capital needs, offering businesses the ability to handle unexpected costs or take advantage of lucrative opportunities quickly and effectively.

A loan and a cash advance are two different types of financial aid used by businesses, and they come with distinct differences. A loan is a type of debt where a lender, often a bank, provides a lump sum of money upfront, and the borrower repays the amount over a set period with interest. The repayment schedule is usually monthly and the interest rate is typically fixed.

On the other hand, a cash advance is a short-term funding option where the funder provides a lump sum of money that the borrower repays through a fixed percentage of their future sales. Also, cash advances use a factor rate instead of an interest rate to calculate the total repayment amount. This makes cash advances a flexible, but often more expensive, option than traditional business loans.

Here is how a merchant cash advance generally compares to business credit cards and small business term loans. Note that these qualities can change based on the specifics of the specific financing type and the applicant’s creditworthiness.

Merchant Cash Advance:

Credit Requirements: Low

Repayment frequency: Daily or weekly

Maximum financing amount: $2 million

Business Credit Card:

Credit Requirements: Medium

Repayment frequency: Monthly

Maximum financing amount: $100,000

Term Loan:

Credit Requirements: High

Repayment frequency: Monthly

Maximum financing amount: $5 million

When choosing a financing option, due diligence is essential. Also, know that funding timelines vary from funder to funder. While many funders deliver the cash advance to the borrower’s account within 24 hours, a larger merchant cash advance from some funders could take more than a week to arrive.

Ready for funding?

See what you can qualify for on the Lendio Marketplace.

.avif)

%202.avif)